Charles Schwab & Co.

Designing Confidence for Millions of Retirees

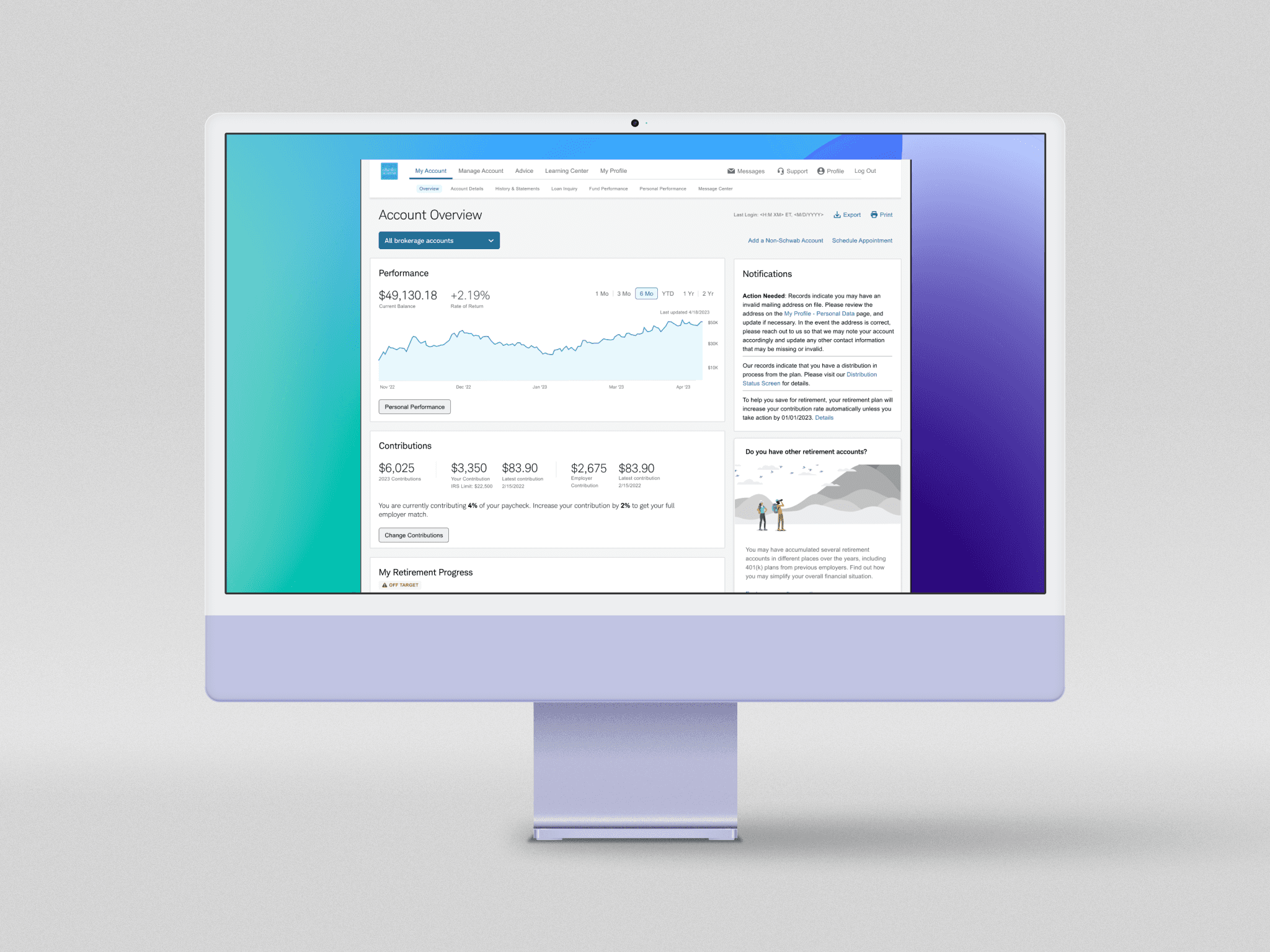

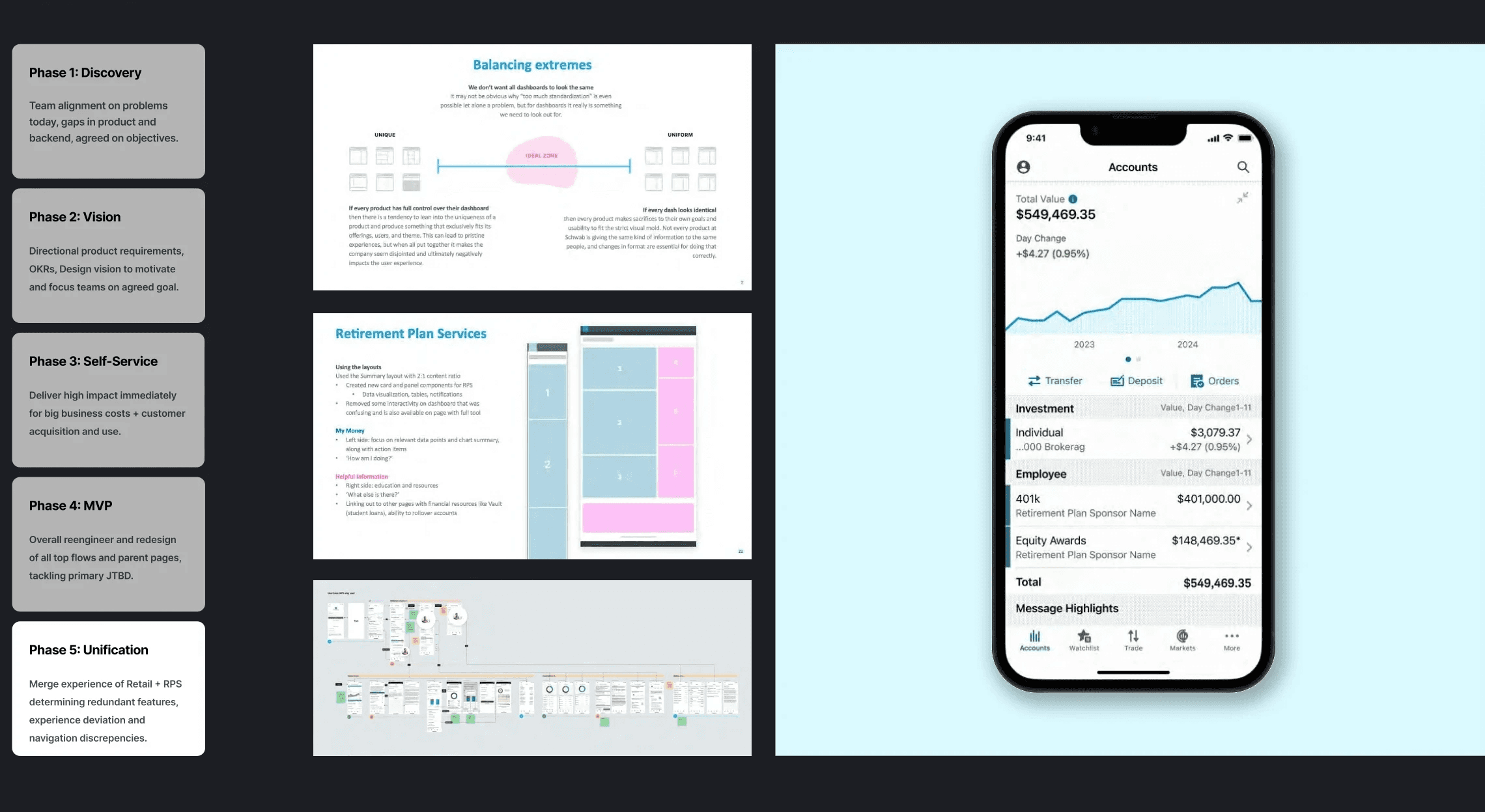

Schwab was investing in unifying their app ecosystem. My team needed to modernize a sprawling, multi-audience retirement system to deliver clarity, scale, and competitive agility while minimizing disruption and technical risk.

Scope of work

Website SaaS Design

App Product Design

Multi-Product Platform

End-to-End

Results

Digital Rollover results: increased assets by 44%, increased CTR by 28%

Key Callouts

Future-proofing in mind: Created dynamic and scalable solutions for omni-channel and eventual Retail integration

Role

Product Design Director

Date

Aug 2024-Aug 2025

Team

200+ teammates

Product Design Director, UX Team Manager, 5 Designers, 1 Researcher, 1 Content, 10 Scrum teams (80 engineers), 7 Product teams (14 product employees), 5 Marketers, 5 Business Strategists

Problem

Schwab’s retirement platform—serving 1.8 million users and managing $237 billion—was constrained by aging architecture, monolithic user flows, and a fragmented user experience across distinct audiences (participants, plan sponsors, advisors). Each audience had distinct needs, yet shared a single outdated infrastructure. Technical debt slowed delivery, maintenance costs soared, and the fragmented experience eroded trust.

We needed to modernize to:

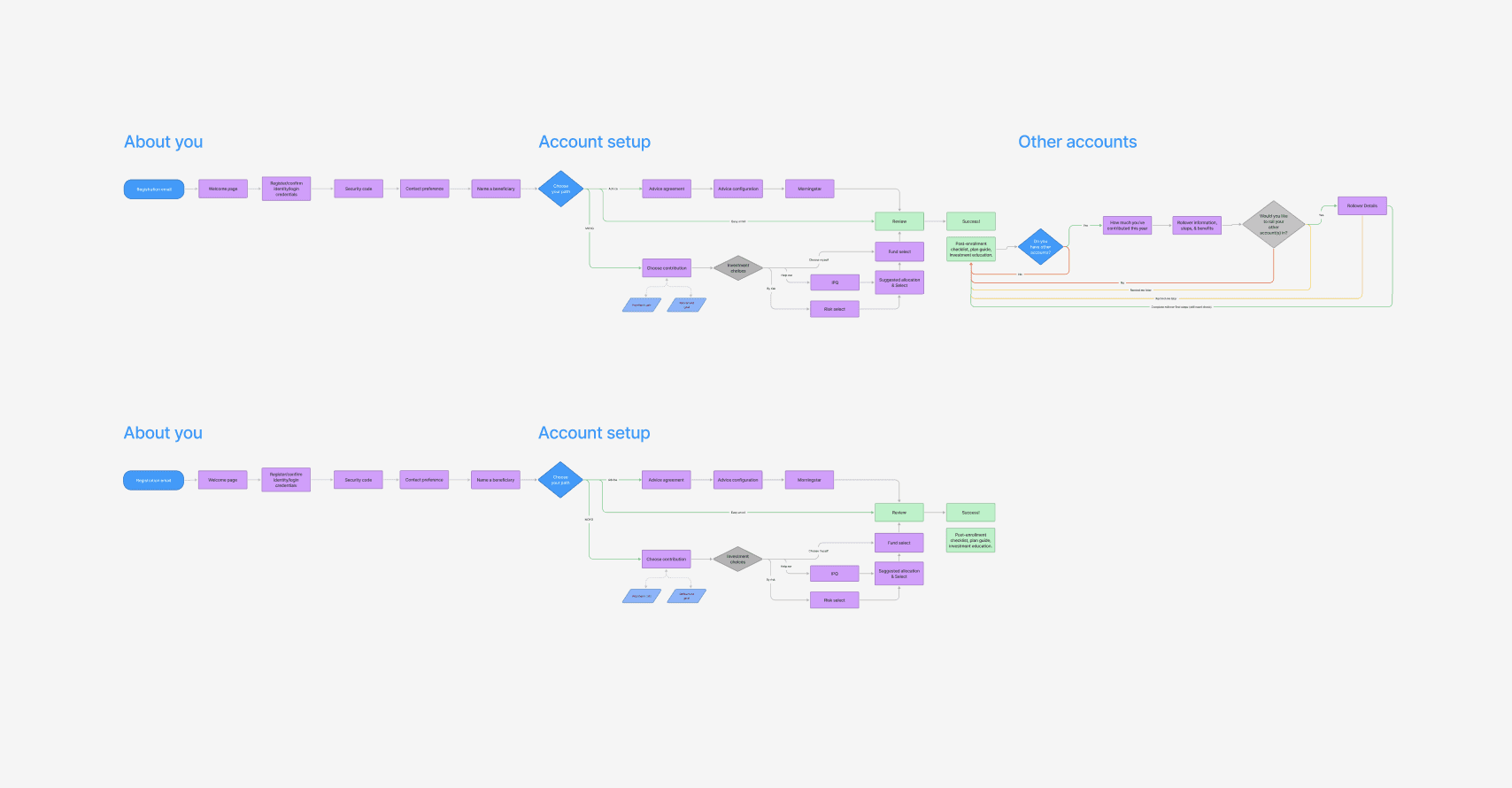

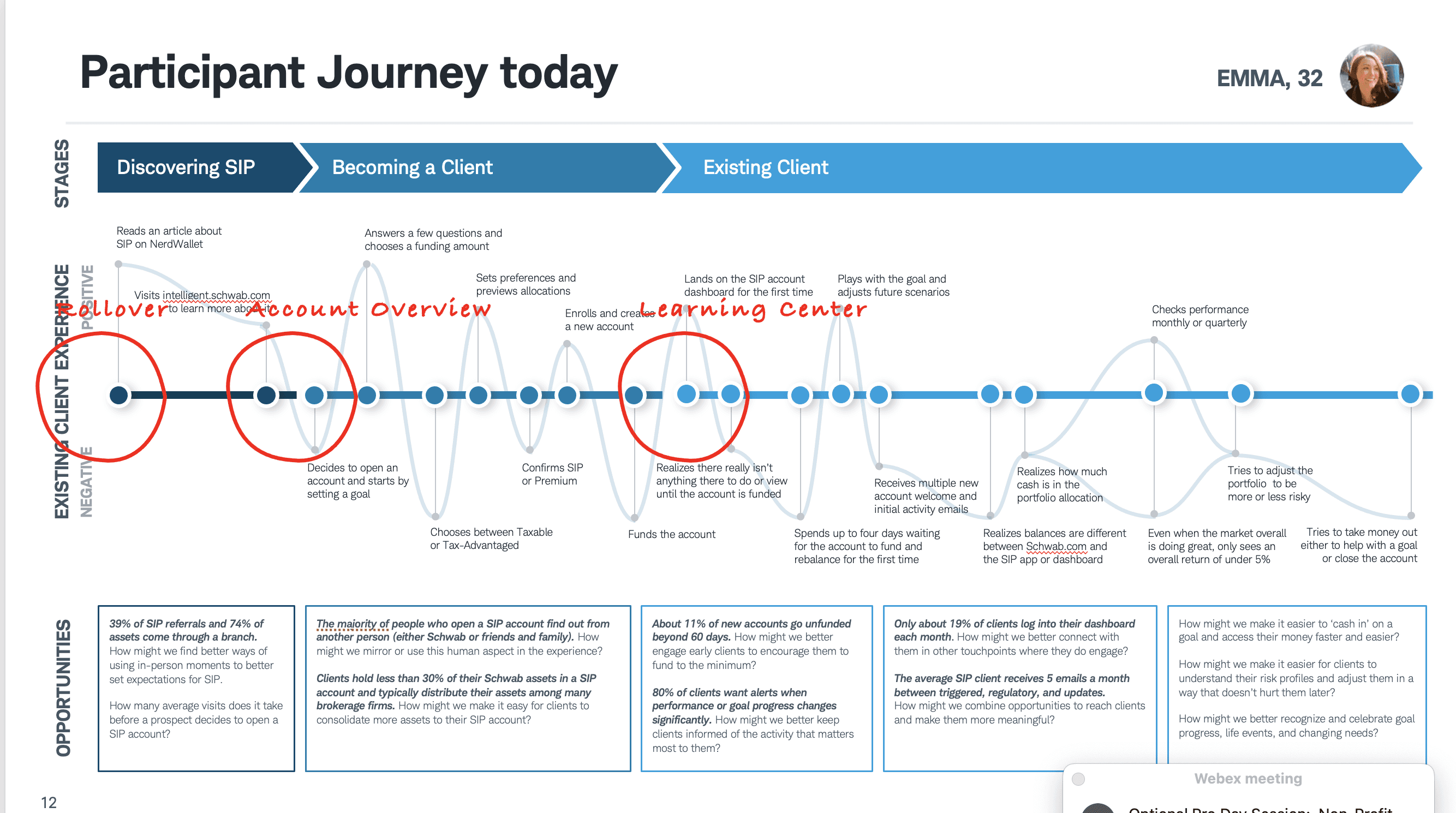

Simplify complex user journeys across 5+ distinct audiences (novice participants to plan sponsors and advisors).

Deepen client relationships through personalization and financial wellness tools.

Expand digital capabilities to remain competitive and scalable.

The Approach

Start with understanding

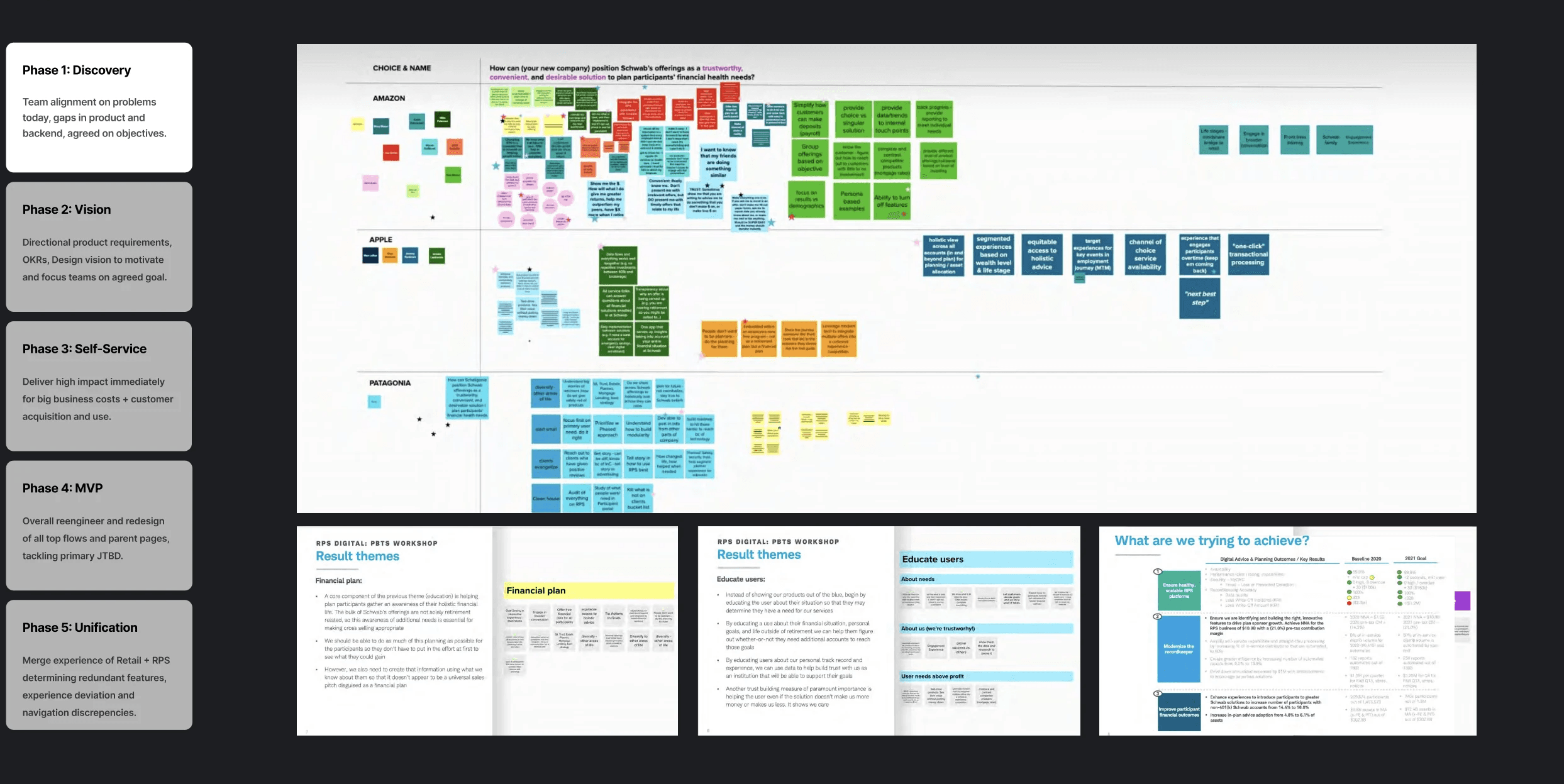

01/ In order to rebuild the foundation for future growth—we needed to align user needs, business priorities, and engineering realities to create a scalable and usable experience.

02/ My team led a discovery phase that mapped journeys to expose friction, confusion and lack of understanding. We reframed competing needs into a single design vision: clarity and confidence at every step.

03/ We leveraged quantitative data to validate design decisions and measure behavioral shifts in live environments. This allowed us to understand larger trends, benchmark and find "scents" to start hypothesizing.

Balance short-term wins with long-term vision

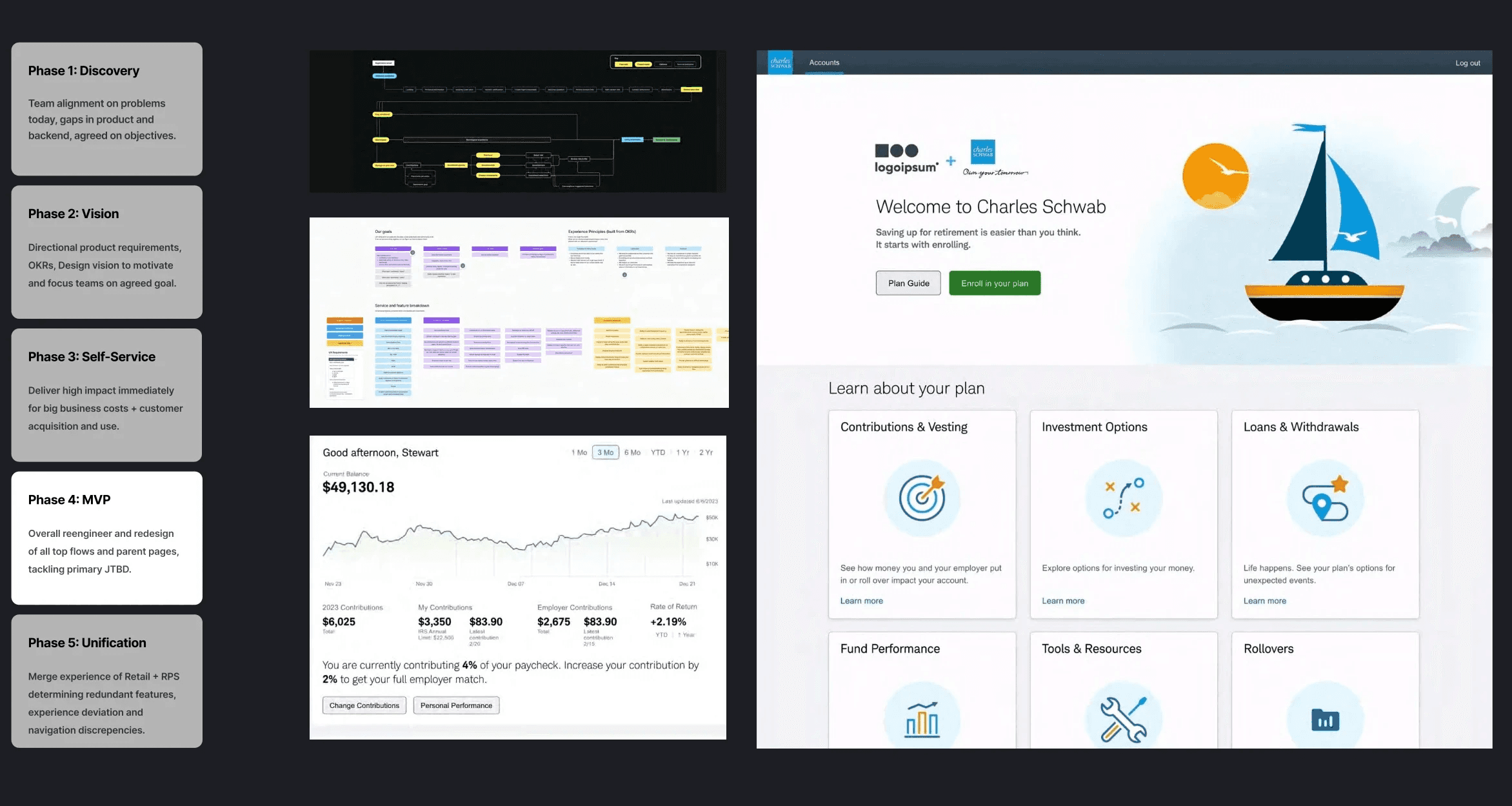

01/ Partnering with engineering and data architecture, we mapped the existing tech stack and identified high-impact migration paths. This prevented short-term design gains from creating long-term debt and informed how we phased releases.

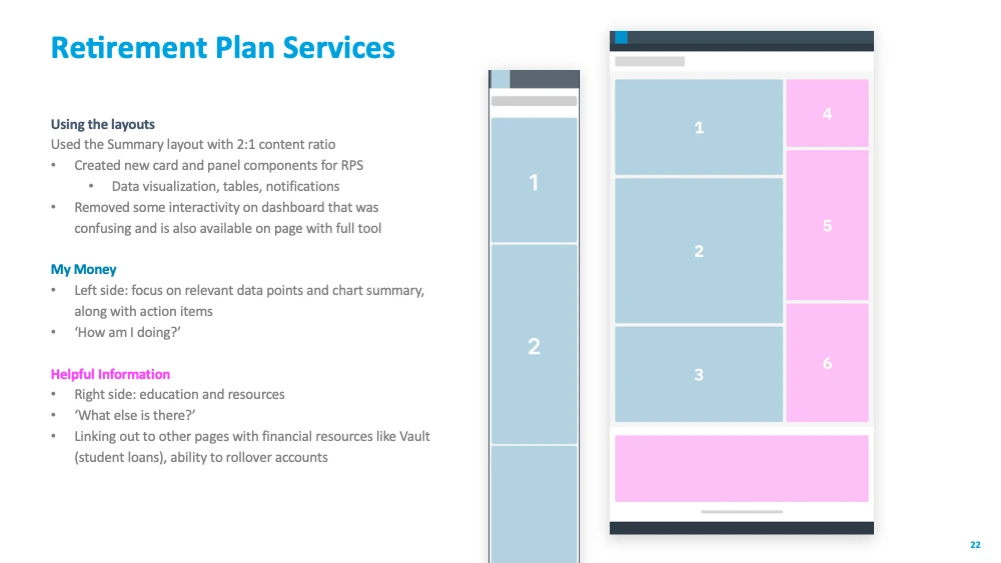

02/ We were able to influence and build with Schwab’s design system team to drive consistency in patterns and components across platforms, while also working in bespoke needs for our user segment groups who were a novel client base.

03/ Because of our product was additionally integrating with Schwab.com from a standalone platform, I developed a strategy to integrate our product in the navigation and menu needs of the larger enterprise. This would two-fold our impact to our own clients and the larger Schwab by cleaning the information architecture for better findability, task completion and trust of the company.

Build process maturity and team fluency

01/ I created UX Bootcamps to teach product and engineering teams design thinking and critique, and introduced a UX-QA process to catch usability issues before launch. These small changes built trust and transformed collaboration.

02/ I launched UX Bootcamps for PMs and engineers to build shared language, empathy, and critique habits. For added speed, I embedded UX-QA reviews into sprints, improving cross-team alignment and catching usability friction early.

Deliver momentum and influence.

01/ I worked closely with leadership to translate design insights into roadmap priorities. By tying design improvements directly to business KPIs, we secured funding and buy-in for continued modernization.

02/ By developing an honest and trusted relationships with my partners, I was able to guide critical metrics, articulate needs for my team, and resolve conflict by nipping it at the bud.

IMPACT

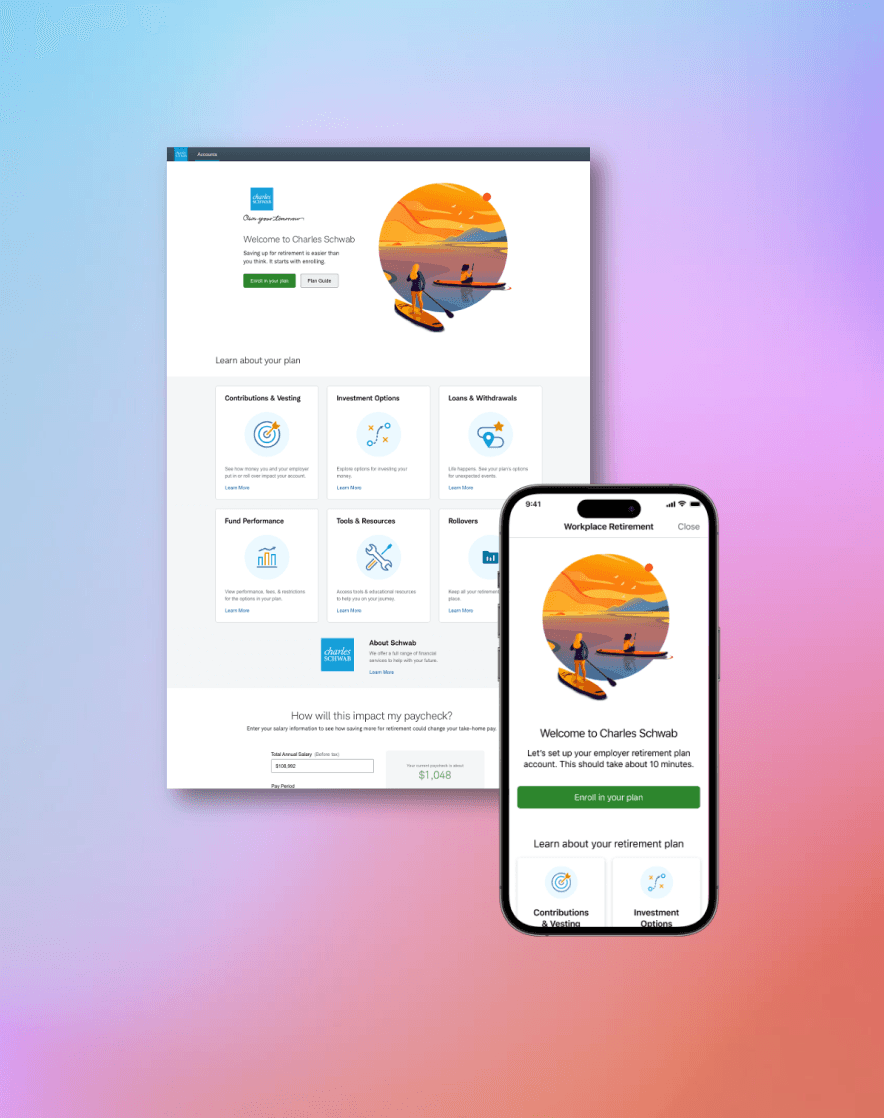

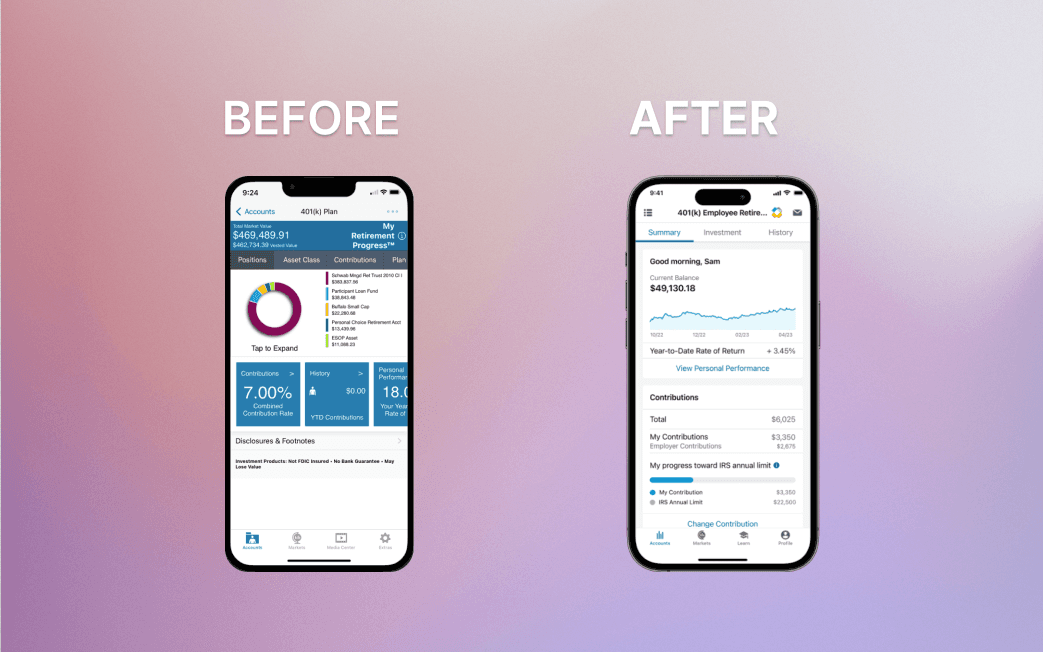

01/ In under 3 years, we re-architected Schwab’s retirement experience from the ground up—launching six interconnected products across onboarding, rollover, dashboards, and sponsor tools.

02/ The redesigned retirement experience gave millions of investors a clearer path to financial confidence—and set a new bar for design maturity inside Schwab.

+44% rollover assets and +28% click-through rate on redesigned flows

$4 M annual cost savings by retiring legacy systems

NPS doubled (3 → 6), reflecting stronger trust and comprehension

34 UX releases in 2024, maintaining momentum across refactors

Laying the foundation for process & culture

But beyond the numbers, this work changed how teams at Schwab build together—creating alignment, clarity, and confidence at every level.

01/ Created UX Bootcamps to educate 60+ cross-functional teammates, building empathy and shared practices.

02/ Developed a UX-QA process inside Agile, increasing efficiency and trust by 200%.

03/ Raised design maturity on team. My team sat beside our partners and built processes, and aligned on practices.

"I worked alongside Elysia Garbade for close to 10 years at Schwab and Transamerica. Elysia is a wonderful team leader, and takes time to listen and coach her team members through design challenges. She's an exceptional collaborator across stakeholder groups, and able to lead product + business through design swarms which lead to accelerated decision making + faster time to market. She also has a keen understanding of customer needs + business drivers, and able to connect design recommendations to jobs to be done + business outcomes. A few examples to point to: leading the Schwab Intelligent Portfolios to more than $80 billion in assets under management, revamping the 401k plan sponsor + participant experience at Transamerica and Schwab, and building a team of product designers known for collaboration, quick design delivery that scales across the ecosystem and helping everyone across the team shine."

Brice Stokes, Sr. UX Design Director, Charles Schwab

☕️

Don't be a stranger –

I'd love to grab coffee and chat

One of my favorite things is meeting new people and seeing what their super-strengths are.

Send me an email to connect.