N26 Bank

N26 Insurance Wallet

As UX Lead at N26, I drove the end-to-end design of a new insurance wallet feature. I defined customer segmentation and feature validation to MVP definition and launch—balancing user needs with business viability and technical feasibility.

Scope of work

User Research & Segmentation

Product Strategy & Roadmap

Design Sprint facilitation

Agile Development Collaboration

Results

Research scaled 1,600%

Key Callouts

Established research methods that scaled across entire organization (previously zero UX research existed)

Role

Lead Product Designer

Date

2017-2018

Team

14 teammates

UX Lead Product Owner CEO Valentin Stalf, CTO Maximilian Tayenthal, CPO Markus Mueller + 5 SMEs (sprint week) 6 Engineers 1 QA 3rd party insurance vendor partner

Problem

N26 was building an insurance wallet to disrupt a €1.31 trillion European market dominated by complex, paper-heavy processes. But we were starting from zero: no customer segmentation, no validated feature set, and no clarity on how to balance user needs with vendor API capabilities and business monetization. As CEO Valentin Stalf noted, "When it comes to insurance, customers today still have to contend with complex and outdated processes and paperwork." We needed to define who would value this product, what problems it would solve, and how to build it without overcommitting resources to unproven assumptions.

We needed to:

Identify customer segments who would find value in an insurance aggregation product within a banking app

Identify customer segments who would find value in an insurance aggregation product within a banking app

Drive new revenue streams while disrupting a €1.31 trillion European market dominated by complex, paper-heavy processes

The Approach

Start with understanding the customer

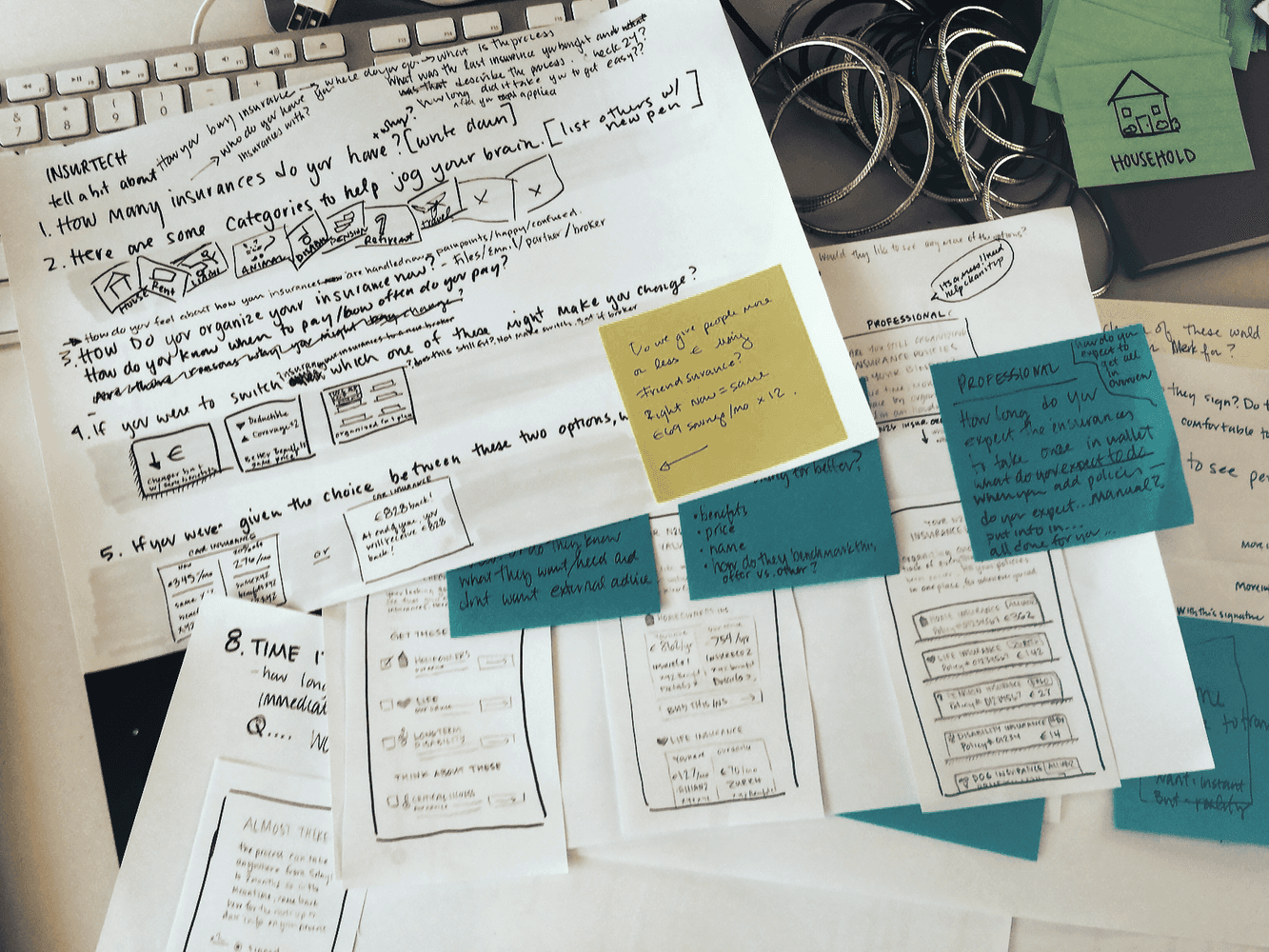

01/ The Product Owner and I began with surveys and customer interviews to assess interest in insurance management. After identifying interested users, we built a research panel that grew from 10 to 160 participants—a 1,600% increase—who participated in ongoing surveys, interviews, and concept tests.

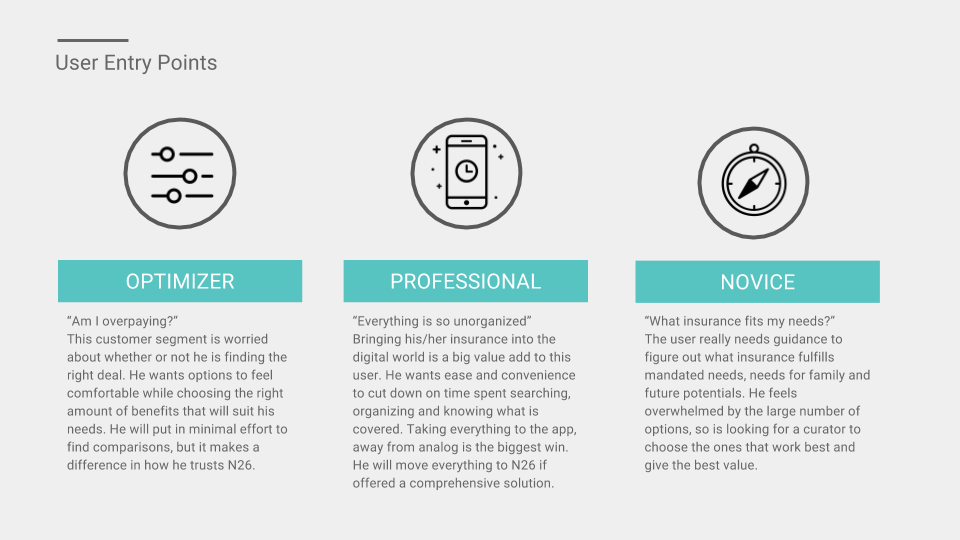

02/ This deep dataset allowed us to theme our findings into 3 distinct personas:

The Optimizer: Focused on finding deals and assessing economic value—wanted the best price

The Professional: Valued efficiency and trusted comprehensive solutions—wanted organized, time-saving tools

The Novice: Exploratory mindset—wanted to understand what's necessary versus nice-to-have

03/ These personas naturally mapped to a phased roadmap approach. The Novice represented our MVP with modest features we could pressure test for market traction. The Professional's feature set increased user benefits but required more complex backend scope and vendor API development. The Optimizer persona proved too costly to serve—users wanted deal comparison and best pricing, but our business model prioritized convenience over price optimization, making this segment unfeasible.

Validate assumptions at the highest level

01/ This project was critical to N26's innovation suite, so we used the Google Design Sprint framework. Our multidisciplinary team worked alongside CEO Valentin Stalf and the CTO to validate original assumptions, prototype, and test within one week.

02/ The biggest outcome was executive buy-in. The CEO had strong opinions about product direction that were difficult to push against. By bringing him directly into user research sessions, he heard actual people struggle with our product. He witnessed how marketing language wasn't hitting core user needs—what he thought was smooth and easy to understand completely missed users' trust issues and confusion around insurance. This transformed his approach from opinion-driven to user-centered decision making.

03/ We tested a scaled-down MVP version to see if it could still move the needle with limited features. It did. The team's collaborative building and refining process validated and increased enthusiasm and confidence in Product and UX's original concept.

Define features through participatory design

01/ I ran participatory design sessions to define feature must-haves and Jobs To Be Done. Through guerrilla research at coffee shops, I maintained a steady stream of users for concept framework tests to understand ease of interaction design uptake.

02/ Usability research revealed three critical user needs divided equally across our personas—Organizer, Optimizer, and Novice—but feasibility and monetization quality determined what we could build:

Trust was the primary barrier. A third-party vendor added complications. We needed incredibly clear messaging about how insurance would work, plus social proof and reviews. Users specifically distrusted brokers, so we had to fight this by showing transparency and demonstrating we had their back.

Transparency and Convenience followed close behind. Users faced five core problems:

Confused by overwhelming insurance information

Claim handling was hard to figure out

Didn't understand why or which insurance they needed

Customer service concerns and trust issues

No clear coverage overview, too much paper hassle

03/ Our unique selling proposition emerged from these insights:

Easy-to-read overview of insurance policy information

Peace of mind through in-app claim reporting and handling

In-app easy cancel button

Reminder alarms for policies ending and auto-renewing

Make complex information approachable

01/ Users were overwhelmed by insurance jargon and technical language. We simplified by stripping away marketing speak and focusing on a 7th grade reading level. We called out users' key questions and answered those directly in the available space. If they wanted more detail, they could dig deeper—but the primary experience prioritized clarity.

02/ Information architecture became critical. We housed everything in a "wallet"—a mental model users already understood for storing important cards. This wallet contained everything they'd need: rates, cancellation details, contact information. The flow took just 2 minutes to complete (depending on research needs and regulatory requirements).

03/ The experience felt like a game rather than a chore through fun illustrations that connected with N26's brand and brought humor to insurance. Interactions were so simple that something as dense and complicated as insurance became enjoyable and easy to accomplish.

Impact

01/ The research methods I established for this project scaled across the entire organization. Previously, N26 had zero UX research, product-market fit studies, or usability testing. After Insurance, research became foundational to how teams built products.

02/ The Google Design Sprint model created a template for rapid validation with executive involvement. By bringing the CEO into user research, I demonstrated the power of direct user feedback over internal opinions—a shift that influenced how future products were validated.

03/ Early cross-functional collaboration became the new standard. Including development in strategy and design from day one, with ongoing conversations about constraints and build approaches, proved more effective than traditional handoffs.

Established foundation for European insurance disruption

01/ The phased persona-driven roadmap allowed N26 to test with modest MVP features (Novice segment), gain market feedback, then expand to more complex offerings (Professional segment) while avoiding costly features for price-sensitive users (Optimizer segment).

02/ By identifying that users needed trust, transparency, and convenience over price optimization, we positioned N26's insurance offering correctly—not as the cheapest option, but as the easiest and most organized.

03/ The product launched three years after my foundational work, validating that the research insights, persona segmentation, and feature prioritization held true through continued development and market evolution.

"Elysia is one of the best senior UI/UX designers out there. I've worked closely with her on two high-impact projects and was impressed by her ability to combine business and user needs into beautiful, frictionless features. She's also a great mentor and I've seen junior designers who blossomed under her tutelage and guidance. I would jump at the opportunity to work with Elysia again."

Wendi Li, Product Owner, N26

☕️

Don't be a stranger –

I'd love to grab coffee and chat

One of my favorite things is meeting new people and seeing what their super-strengths are.

Send me an email to connect.